Core Insurance

Fanavaran’s Core Insurance Solution to cover entire policy management in all fields of insurance domain (life and non-life)

Fanavaran’s main product is Bonyan® (Core Insurance Solution) which covers the entire policy management from underwriting to claim processing, endorsement, financial, and reinsurance in all insurance areas including but not limited to Vehicle Insurance, Motor Third Party Insurance, Marine Insurance, Liability Insurance, All Risk Insurance, Fire Insurance, Accident & Life Insurance, Health Insurance, Group Life Insurance, Group Health Insurance, Home Service, Property Insurance, Livestock Insurance, Burglary Insurance, Agricultural Insurance, Professional Indemnity Insurance, Travel Insurance, Annuity Insurance and so forth.

- Comprehensiveness of insurance areas

- Comprehensiveness of policy management operations

- Integrity of processes and data

- Supporting of big data

- Business Rules Management

- Expandability

Core Insurance

EXCLUSIVE PRODUCT

why you need it?

The strength of lorem ipsum is its weakness: it doesn't communicate. To some, designing a website around placeholder text is unacceptable, akin to sewing a custom suit without taking measurements. Kristina Halvorson notes:

More details

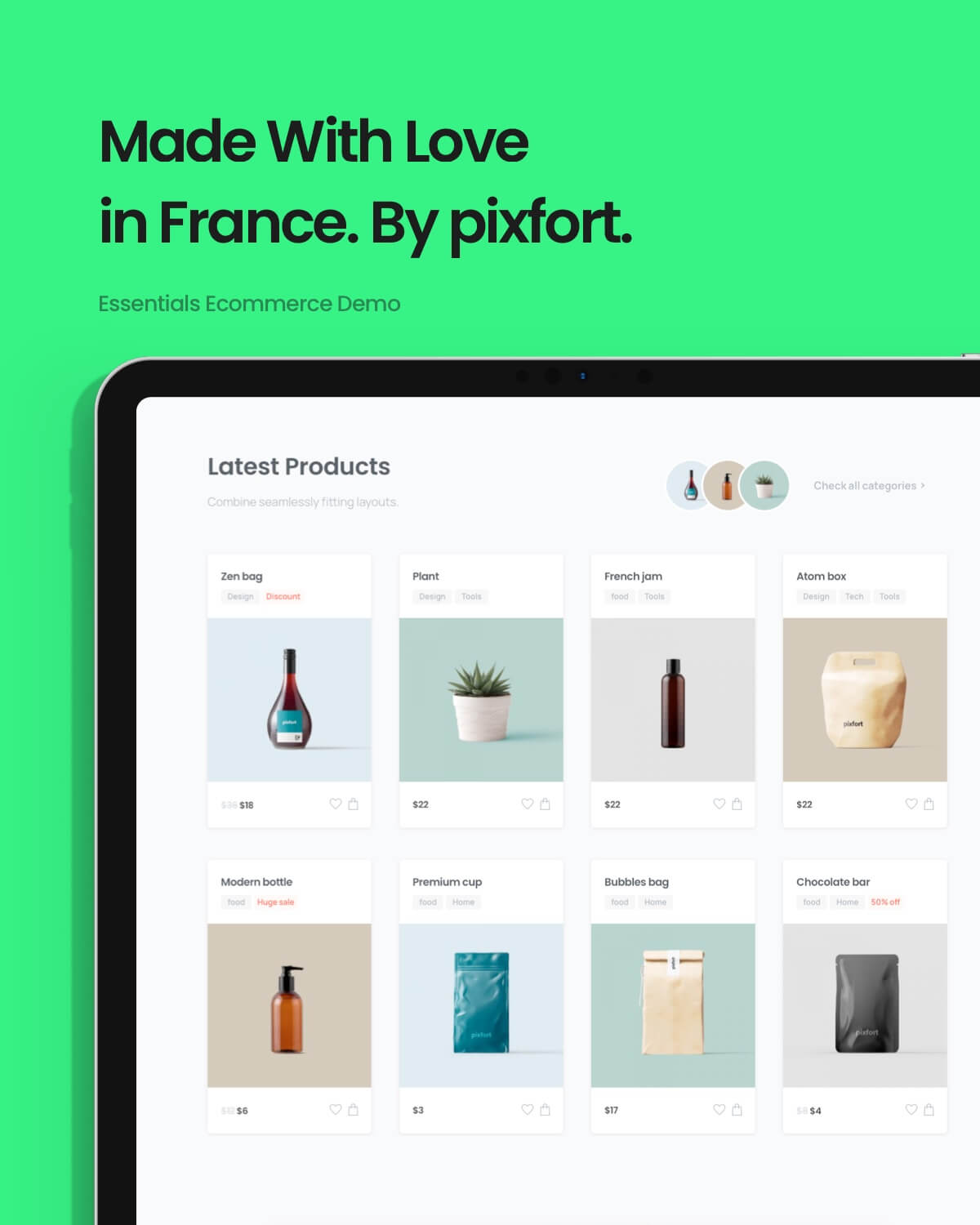

IMPROVED USER INTERFACE

It's super easy to use Bonyan

The strength of lorem ipsum is its weakness: it doesn't communicate. To some, designing a website around placeholder text is unacceptable, akin to sewing a custom suit without taking measurements. Kristina Halvorson notes:

EXCLUSIVE PRODUCT

why you need it?

Fanavaran’s main product is Bonyan® (Core Insurance Solution) which covers the entire policy management from underwriting to claim processing, endorsement, financial, and reinsurance in all insurance areas including but not limited to Vehicle Insurance, Motor Third Party Insurance, Marine Insurance, Liability Insurance, All Risk Insurance, Fire Insurance, Accident & Life Insurance, Health Insurance, Group Life Insurance, Group Health Insurance, Home Service, Property Insurance, Livestock Insurance, Burglary Insurance, Agricultural Insurance, Professional Indemnity Insurance, Travel Insurance, Annuity Insurance and so forth.

SUPER EASY TO USE

No need to write a single line of code.

This is just a simple text made for this unique and awesome template, you can replace it with any text you want in seconds.